Seaport Global Downgrades PPG Industries (PPG)

Fintel reports that on March 5, 2025, Seaport Global downgraded their outlook for PPG Industries (NYSE:PPG) from Buy to Neutral.

Analyst Price Forecast Suggests 24.64% Upside

As of March 4, 2025, the average one-year price target for PPG Industries is $136.22/share. The forecasts range from a low of $121.20 to a high of $174.30. The average price target represents an increase of 24.64% from its latest reported closing price of $109.29 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for PPG Industries is 18,433MM, an increase of 16.33%. The projected annual non-GAAP EPS is 9.25.

What is the Fund Sentiment?

There are 1,903 funds or institutions reporting positions in PPG Industries.

This is an decrease of 26 owner(s) or 1.35% in the last quarter.

Average portfolio weight of all funds dedicated to PPG is 0.21%, an increase of 4.67%.

Total shares owned by institutions increased in the last three months by 4.08% to 241,014K shares.

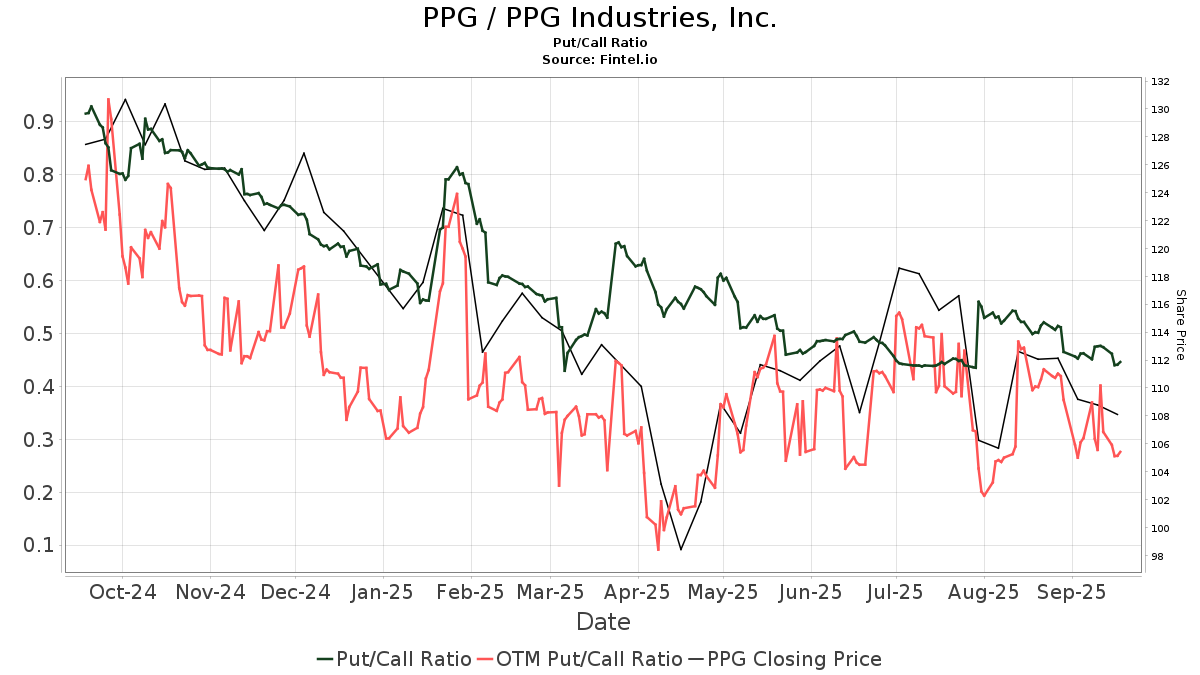

The put/call ratio of PPG is 0.51, indicating a

bullish outlook.

The put/call ratio of PPG is 0.51, indicating a

bullish outlook.

What are Other Shareholders Doing?

Wellington Management Group Llp holds 10,567K shares representing 4.66% ownership of the company. In its prior filing, the firm reported owning 8,977K shares , representing an increase of 15.05%. The firm increased its portfolio allocation in PPG by 10.99% over the last quarter.

Jpmorgan Chase holds 10,273K shares representing 4.53% ownership of the company. In its prior filing, the firm reported owning 9,560K shares , representing an increase of 6.93%. The firm decreased its portfolio allocation in PPG by 5.05% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 7,270K shares representing 3.20% ownership of the company. In its prior filing, the firm reported owning 7,391K shares , representing a decrease of 1.67%. The firm decreased its portfolio allocation in PPG by 12.59% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 6,280K shares representing 2.77% ownership of the company. In its prior filing, the firm reported owning 6,110K shares , representing an increase of 2.70%. The firm decreased its portfolio allocation in PPG by 12.32% over the last quarter.

Geode Capital Management holds 5,546K shares representing 2.44% ownership of the company. In its prior filing, the firm reported owning 5,453K shares , representing an increase of 1.68%. The firm decreased its portfolio allocation in PPG by 12.16% over the last quarter.

PPG Industries Background Information

(This description is provided by the company.)

PPG works every day to develop and deliver the paints, coatings and materials that its customers have trusted for more than 135 years. Through dedication and creativity, it solves its customers' biggest challenges, collaborating closely to find the right path forward. With headquarters in Pittsburgh, it operates and innovate in more than 70 countries and reported net sales of $13.8 billion in 2020. It serves customers in construction, consumer products, industrial and transportation markets and aftermarkets.