Raymond James Initiates Coverage of Karman Holdings (KRMN) with Strong Buy Recommendation

Fintel reports that on September 5, 2025, Raymond James initiated coverage of Karman Holdings (NYSE:KRMN) with a Strong Buy recommendation.

Analyst Price Forecast Suggests 11.46% Upside

As of September 3, 2025, the average one-year price target for Karman Holdings is $59.50/share. The forecasts range from a low of $57.57 to a high of $63.00. The average price target represents an increase of 11.46% from its latest reported closing price of $53.38 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual non-GAAP EPS is 0.35.

What is the Fund Sentiment?

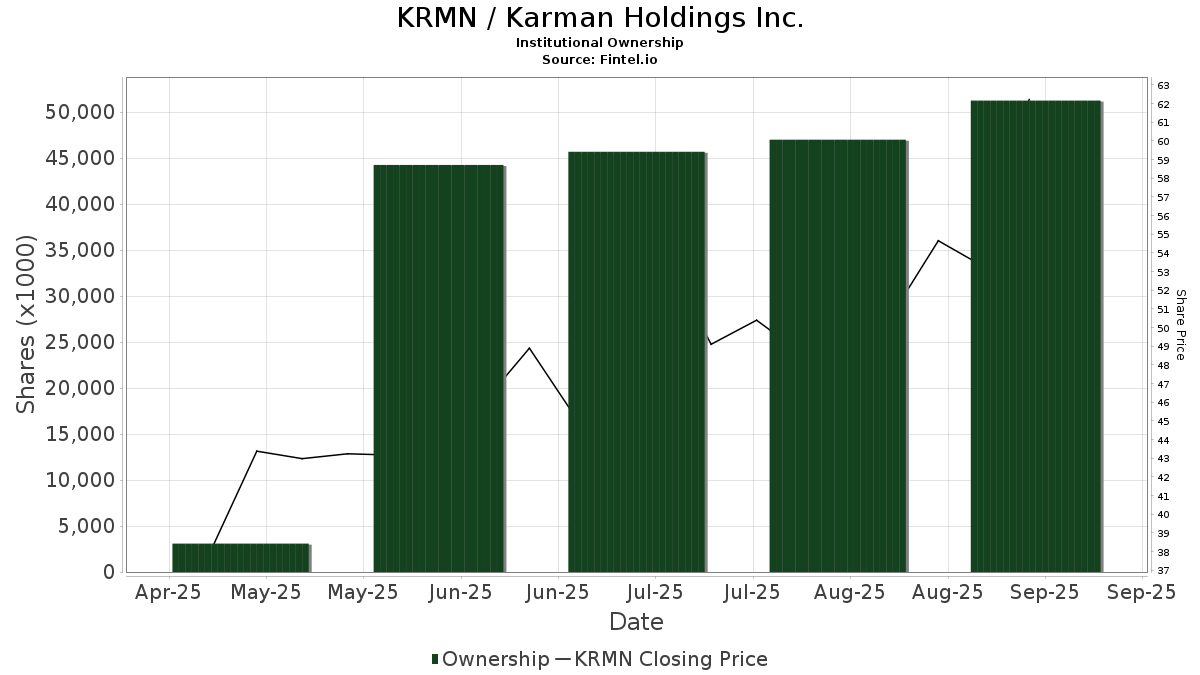

There are 318 funds or institutions reporting positions in Karman Holdings.

This is an increase of 93 owner(s) or 41.33% in the last quarter.

Average portfolio weight of all funds dedicated to KRMN is 0.24%, an increase of 31.37%.

Total shares owned by institutions increased in the last three months by 15.90% to 51,292K shares.

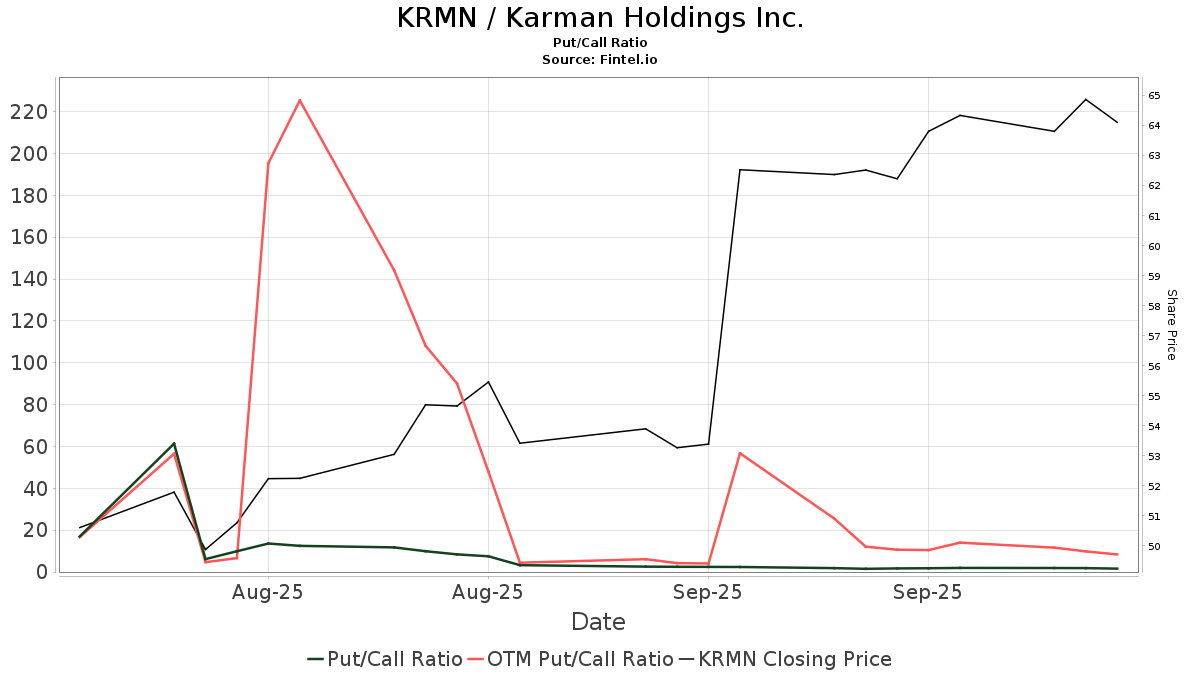

The put/call ratio of KRMN is 2.49, indicating a

bearish outlook.

The put/call ratio of KRMN is 2.49, indicating a

bearish outlook.

What are Other Shareholders Doing?

SMCWX - SMALLCAP WORLD FUND INC holds 3,181K shares representing 2.40% ownership of the company. In its prior filing, the firm reported owning 3,832K shares , representing a decrease of 20.46%. The firm increased its portfolio allocation in KRMN by 9.44% over the last quarter.

Capital World Investors holds 2,500K shares representing 1.89% ownership of the company. In its prior filing, the firm reported owning 2,399K shares , representing an increase of 4.06%. The firm increased its portfolio allocation in KRMN by 40.94% over the last quarter.

Bamco holds 2,415K shares representing 1.83% ownership of the company. In its prior filing, the firm reported owning 2,401K shares , representing an increase of 0.60%. The firm increased its portfolio allocation in KRMN by 39.95% over the last quarter.

Price T Rowe Associates holds 2,088K shares representing 1.58% ownership of the company. In its prior filing, the firm reported owning 1,759K shares , representing an increase of 15.76%. The firm increased its portfolio allocation in KRMN by 64.48% over the last quarter.

Invesco holds 1,905K shares representing 1.44% ownership of the company. In its prior filing, the firm reported owning 1,503K shares , representing an increase of 21.12%. The firm decreased its portfolio allocation in KRMN by 85.45% over the last quarter.