Prothena (PRTA) Price Target Decreased by 42.31% to 15.30

The average one-year price target for Prothena (NasdaqGS:PRTA) has been revised to $15.30 / share. This is a decrease of 42.31% from the prior estimate of $26.52 dated August 19, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $4.04 to a high of $30.45 / share. The average price target represents an increase of 85.01% from the latest reported closing price of $8.27 / share.

What is the Fund Sentiment?

There are 427 funds or institutions reporting positions in Prothena.

This is an increase of 46 owner(s) or 12.07% in the last quarter.

Average portfolio weight of all funds dedicated to PRTA is 0.06%, an increase of 40.80%.

Total shares owned by institutions decreased in the last three months by 18.60% to 45,595K shares.

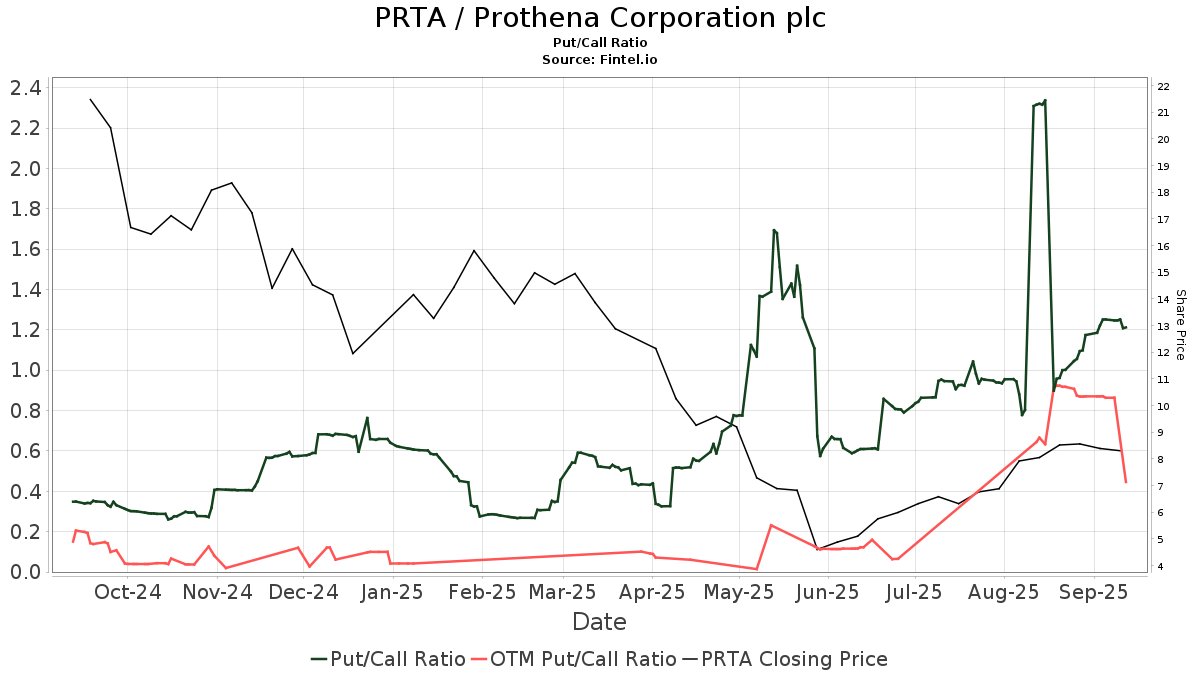

The put/call ratio of PRTA is 1.17, indicating a

bearish outlook.

The put/call ratio of PRTA is 1.17, indicating a

bearish outlook.

What are Other Shareholders Doing?

VGHCX - Vanguard Health Care Fund Investor Shares holds 4,184K shares representing 7.77% ownership of the company. In its prior filing, the firm reported owning 4,220K shares , representing a decrease of 0.85%. The firm decreased its portfolio allocation in PRTA by 29.70% over the last quarter.

ADAR1 Capital Management holds 3,375K shares representing 6.27% ownership of the company. In its prior filing, the firm reported owning 0K shares , representing an increase of 100.00%.

FDGRX - Fidelity Growth Company Fund holds 2,324K shares representing 4.32% ownership of the company. In its prior filing, the firm reported owning 2,318K shares , representing an increase of 0.27%. The firm decreased its portfolio allocation in PRTA by 70.57% over the last quarter.

Armistice Capital holds 2,236K shares representing 4.15% ownership of the company. In its prior filing, the firm reported owning 2,196K shares , representing an increase of 1.79%. The firm decreased its portfolio allocation in PRTA by 53.65% over the last quarter.

PRNHX - T. Rowe Price New Horizons Fund holds 1,638K shares representing 3.04% ownership of the company. In its prior filing, the firm reported owning 1,890K shares , representing a decrease of 15.38%. The firm decreased its portfolio allocation in PRTA by 4.71% over the last quarter.