HC Wainwright & Co. Reiterates Gold Resource (GORO) Buy Recommendation

Fintel reports that on April 14, 2023, HC Wainwright & Co. reiterated coverage of Gold Resource (AMEX:GORO) with a Buy recommendation.

Analyst Price Forecast Suggests 170.80% Upside

As of April 6, 2023, the average one-year price target for Gold Resource is $3.06. The forecasts range from a low of $3.03 to a high of $3.15. The average price target represents an increase of 170.80% from its latest reported closing price of $1.13.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Gold Resource is $135MM, a decrease of 2.55%. The projected annual non-GAAP EPS is $0.15.

What are Other Shareholders Doing?

VARIABLE INSURANCE PRODUCTS FUND II - Total Market Index Portfolio Initial Class holds 2K shares representing 0.00% ownership of the company. No change in the last quarter.

Ancora Advisors holds 541K shares representing 0.61% ownership of the company. In it's prior filing, the firm reported owning 735K shares, representing a decrease of 35.78%. The firm increased its portfolio allocation in GORO by 63,569.12% over the last quarter.

Stephenson National Bank & Trust holds 11K shares representing 0.01% ownership of the company. No change in the last quarter.

BRUSX - Ultra-Small Company Fund Class N holds 936K shares representing 1.06% ownership of the company. No change in the last quarter.

State Street holds 292K shares representing 0.33% ownership of the company. No change in the last quarter.

What is the Fund Sentiment?

There are 149 funds or institutions reporting positions in Gold Resource.

This is an increase

of

5

owner(s) or 3.47% in the last quarter.

Average portfolio weight of all funds dedicated to GORO is 0.22%,

an increase

of 212.80%.

Total shares owned by institutions increased

in the last three months by 3.21% to 36,078K shares.

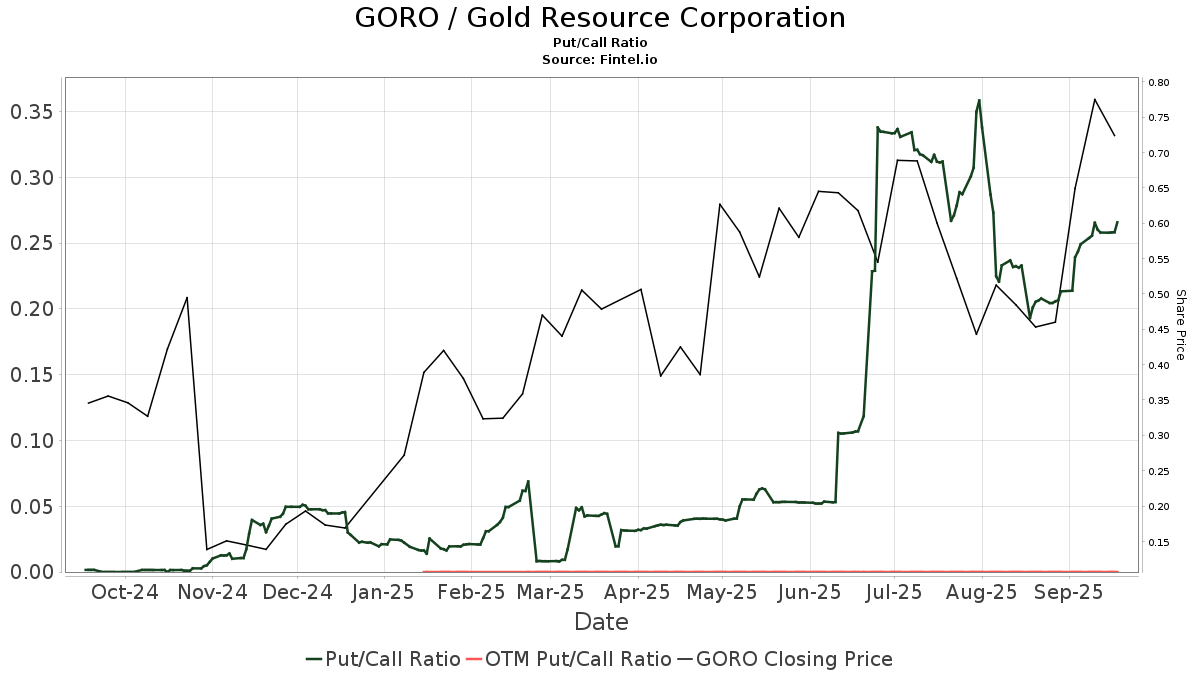

The put/call ratio of GORO is 0.02, indicating a

bullish

outlook.

The put/call ratio of GORO is 0.02, indicating a

bullish

outlook.

Gold Resource Background Information

(This description is provided by the company.)

Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico. The Company's focus is on unlocking the value of the mine, existing infrastructure, and large property position.

See all Gold Resource regulatory filings.