Guggenheim Downgrades Tourmaline Bio (TRML)

Fintel reports that on September 10, 2025, Guggenheim downgraded their outlook for Tourmaline Bio (NasdaqGS:TRML) from Buy to Neutral.

Analyst Price Forecast Suggests 20.45% Upside

As of September 3, 2025, the average one-year price target for Tourmaline Bio is $57.32/share. The forecasts range from a low of $35.35 to a high of $73.50. The average price target represents an increase of 20.45% from its latest reported closing price of $47.59 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Tourmaline Bio is 0MM. The projected annual non-GAAP EPS is -1.62.

What is the Fund Sentiment?

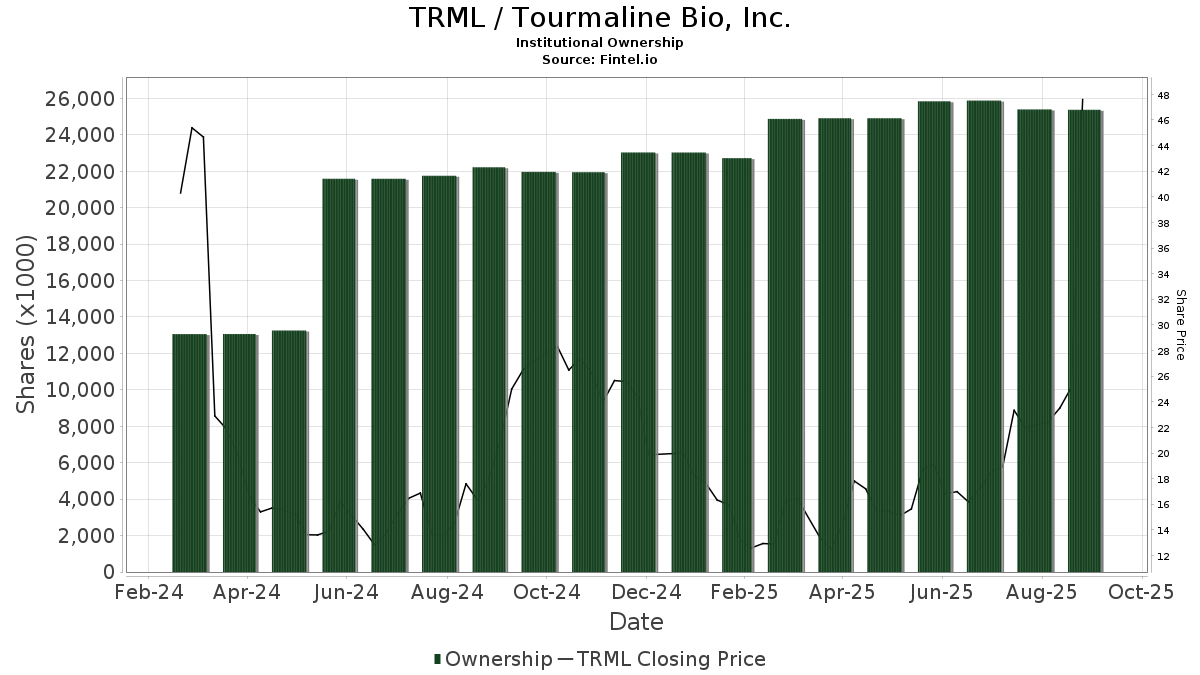

There are 233 funds or institutions reporting positions in Tourmaline Bio.

This is an increase of 12 owner(s) or 5.43% in the last quarter.

Average portfolio weight of all funds dedicated to TRML is 0.39%, an increase of 2.76%.

Total shares owned by institutions decreased in the last three months by 1.80% to 25,373K shares.

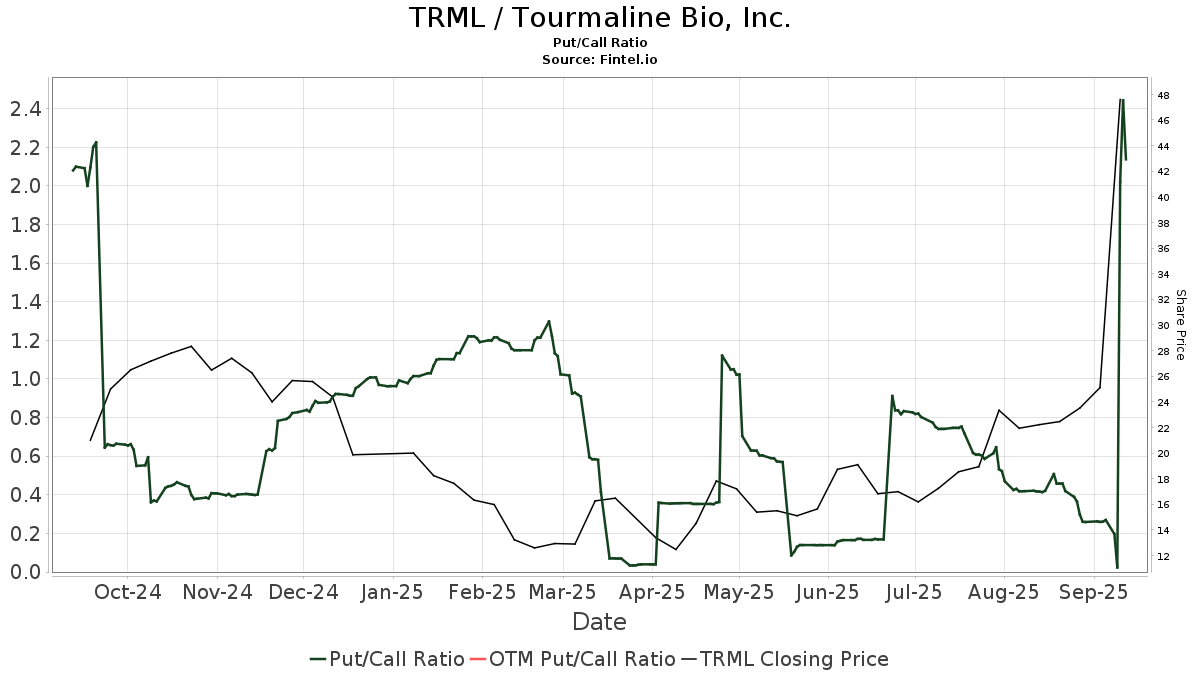

The put/call ratio of TRML is 0.02, indicating a

bullish outlook.

The put/call ratio of TRML is 0.02, indicating a

bullish outlook.

What are Other Shareholders Doing?

Avoro Capital Advisors holds 2,556K shares representing 9.95% ownership of the company. In its prior filing, the firm reported owning 2,425K shares , representing an increase of 5.11%. The firm increased its portfolio allocation in TRML by 24.30% over the last quarter.

Ra Capital Management holds 2,539K shares representing 9.88% ownership of the company. No change in the last quarter.

QVT Financial holds 2,155K shares representing 8.39% ownership of the company. In its prior filing, the firm reported owning 1,473K shares , representing an increase of 31.62%. The firm increased its portfolio allocation in TRML by 48.74% over the last quarter.

TCG Crossover Management holds 1,478K shares representing 5.75% ownership of the company. No change in the last quarter.

Pfizer holds 1,272K shares representing 4.95% ownership of the company. No change in the last quarter.