Alphabet (XTRA:ABEC) Price Target Decreased by 10.08% to 181.81

The average one-year price target for Alphabet (XTRA:ABEC) has been revised to 181,81 € / share. This is a decrease of 10.08% from the prior estimate of 202,20 € dated April 1, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 141,56 € to a high of 222,14 € / share. The average price target represents an increase of 34.78% from the latest reported closing price of 134,90 € / share.

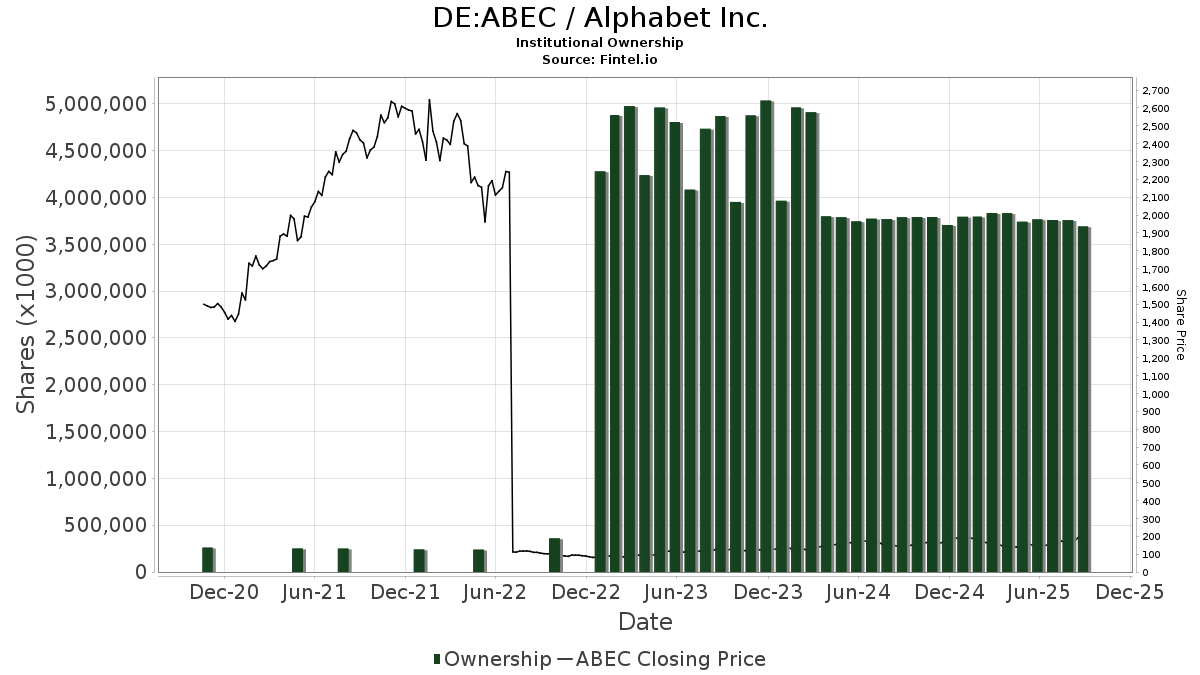

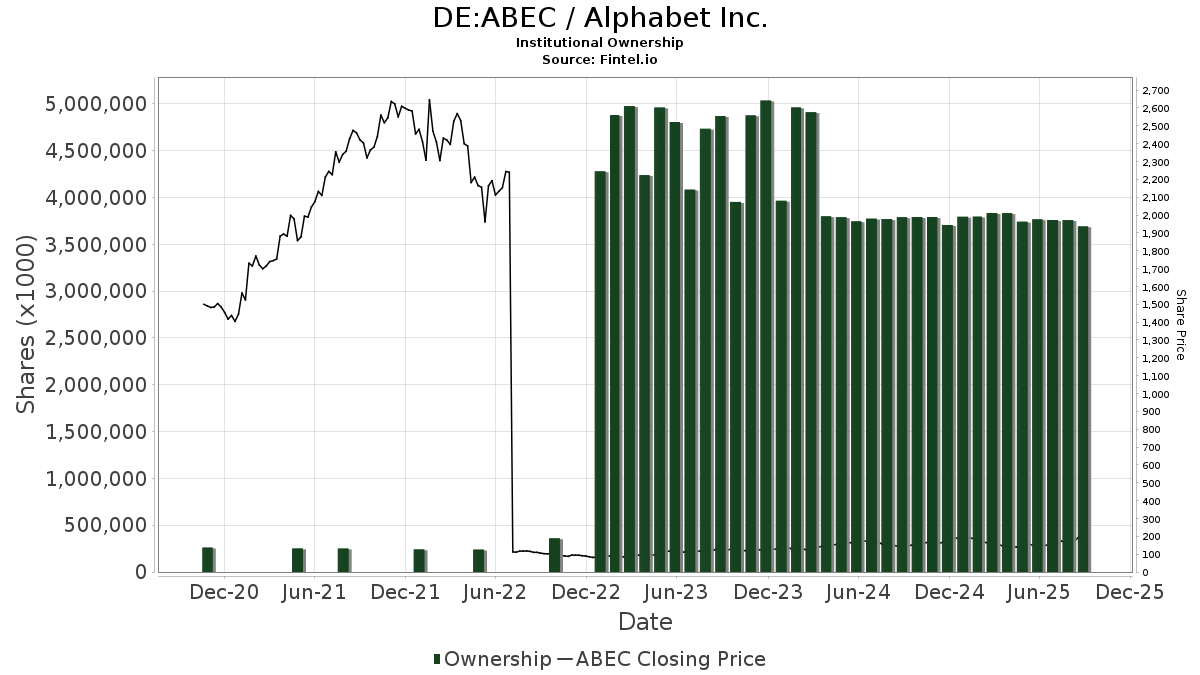

What is the Fund Sentiment?

There are 5,838 funds or institutions reporting positions in Alphabet. This is an increase of 325 owner(s) or 5.90% in the last quarter. Average portfolio weight of all funds dedicated to ABEC is 1.40%, an increase of 134.02%. Total shares owned by institutions increased in the last three months by 0.53% to 3,816,387K shares.

What are Other Shareholders Doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 147,333K shares representing 2.68% ownership of the company. In its prior filing, the firm reported owning 150,497K shares , representing a decrease of 2.15%. The firm increased its portfolio allocation in ABEC by 9.89% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 128,828K shares representing 2.34% ownership of the company. In its prior filing, the firm reported owning 125,807K shares , representing an increase of 2.35%. The firm increased its portfolio allocation in ABEC by 10.35% over the last quarter.

Geode Capital Management holds 104,777K shares representing 1.91% ownership of the company. In its prior filing, the firm reported owning 103,557K shares , representing an increase of 1.16%. The firm increased its portfolio allocation in ABEC by 10.38% over the last quarter.

Jpmorgan Chase holds 92,989K shares representing 1.69% ownership of the company. In its prior filing, the firm reported owning 94,787K shares , representing a decrease of 1.93%. The firm increased its portfolio allocation in ABEC by 9.50% over the last quarter.

Capital International Investors holds 91,236K shares representing 1.66% ownership of the company. In its prior filing, the firm reported owning 85,478K shares , representing an increase of 6.31%. The firm increased its portfolio allocation in ABEC by 19.01% over the last quarter.